Funding Political Pet Projects: the Left Leaves Taxpayers Voiceless

How involved has the state government been in investing in nonprofits?

*This article was originally published by the Connecticut Mirror. It was co-authored by Frank Ricci.

In response to the Trump administration and DOGE’s efforts to curb wasteful federal spending, Connecticut lawmakers allocated nearly $3 million to nonprofits facing potential funding cuts.

Most of this money supports left-leaning causes, including LGBTQ organizations, illegal immigration services, and Planned Parenthood, which received $800,000 — the largest share. Other recipients include Integrated Refugee & Immigrant Services, New Haven Gay and Lesbian Community Center, and Hartford Gay and Lesbian Health Collective.

This spending was enacted via an “emergency certified bill,” circumventing standard legislative processes like public hearings. This is a shameless attempt to shovel federal waste and abuse onto state taxpayers. It’s a brutal slap to transparency and a sneering insult to good governance.

Connecticut taxpayers, who fund these causes, were denied a chance to weigh in. Imagine if the recipients leaned conservative instead — say, pro-life groups like the Connecticut Pregnancy Care Coalition (CPCC) rather than Planned Parenthood. The philosophical divide is stark: one sees abortion as ending a life, the other as a reproductive right. Should a pro-life resident be forced to fund Planned Parenthood through taxes? Or a pro-choice resident fund CPCC?

Switch the ideological bent to any conservative nonprofit, and progressive backlash would likely follow — perhaps justifiably. Taxpayer money, entrusted to lawmakers, should benefit all residents through neutral public goods like roads, sewers, or parks, not divisive causes. Nonprofits, by design, advance specific missions, so ideologically charged ones should rely on voluntary donations, not mandatory taxes.

This raises broader questions not only about fiscal responsibility and transparency, but also the proper role of government. It also warrants a deeper conversation on who and what should be funded, and by how much. After all, what politicians support is what they value.

Government funding of nonprofits has historical roots, taking shape during World War I and the Great Depression. The 1917 War Revenue Act spurred philanthropy with tax deductions for charitable giving. The nonprofit sector boomed in the late 1970s, growing 36% since 2000 to 1.8 million organizations, per Philanthropy Roundtable. Americans are generous, donating $557.16 billion in 2023, dwarfing the U.S. government’s $58.4 billion in international aid for FY 2025. Yet USAID faced scrutiny from the Trump administration for spending on DEI, LGBTQ initiatives, and other questionable projects, leading to an 80% funding cut.

Amid these federal reductions, Connecticut allocated its $3 million to nonprofits at risk.

The state has long supported nonprofits (albeit not as ideologically based), launching the Nonprofit Grant Program (NGP) in 2013. Since then, NGP has awarded over $130 million, backing nearly 750 projects. Today, 33% of Connecticut nonprofits receive state grants.

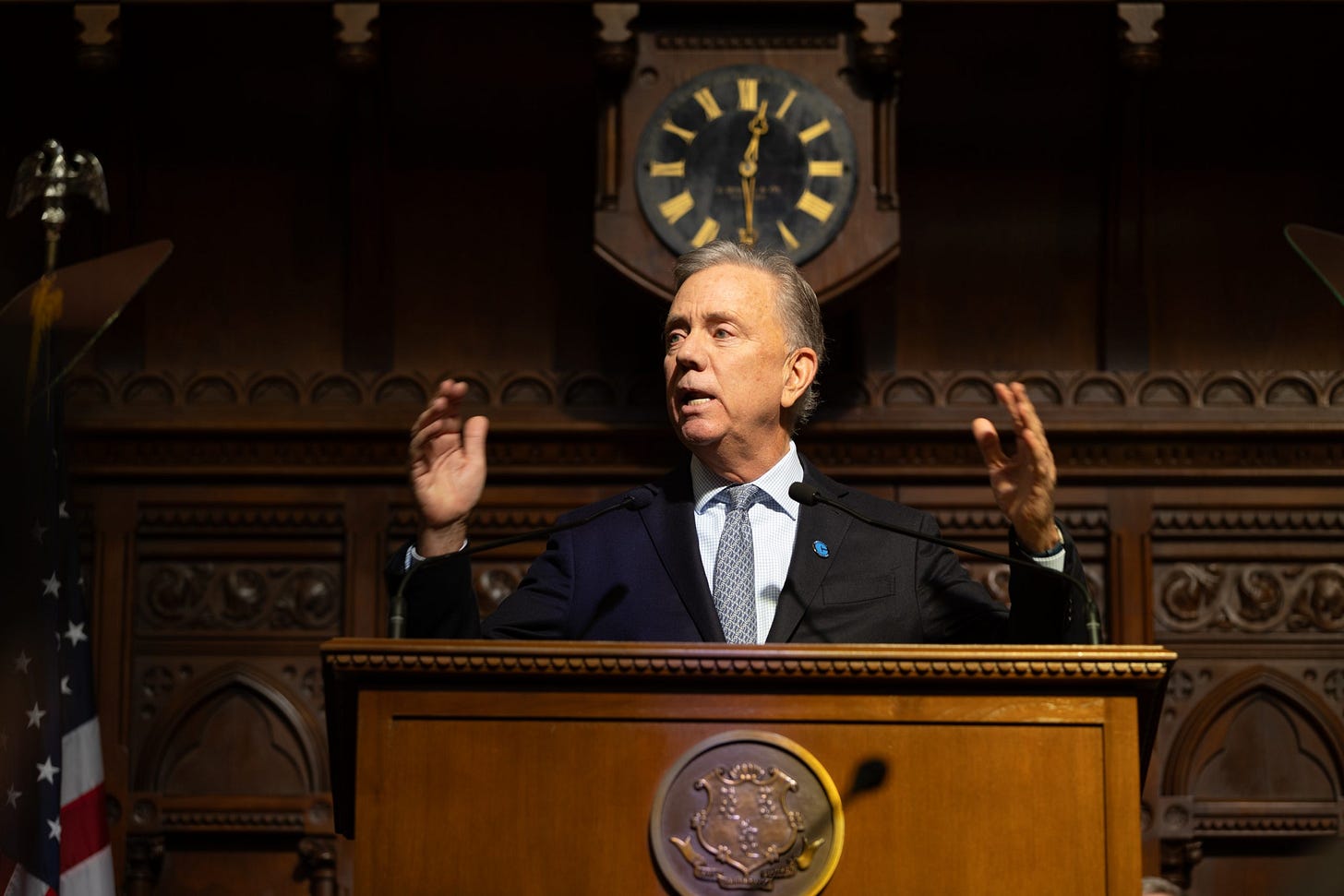

Gov. Ned Lamont’s biennial budget proposed $157 million for nonprofits, but the Connecticut Nonprofit Community Alliance (“The Alliance”) calls it insufficient. The group’s president, Gian Carl Casa, noted in a Feb. 5 press release that, without annualized federal ARPA funds, it’s effectively a $19 million cut. The Alliance is seeking $264 million, citing a “crisis,” emphasizing that nonprofits have 30% less buying power than in 2007, with 80% struggling to retain staff, 70% facing rising demand, and over 60% operating at a deficit or thin margins.

To address this, The Alliance urges “reasonable adjustments” to Connecticut’s fiscal guardrails — 2017 reforms that averted a financial crisis. They argue the state can balance discipline with funding for housing, mental health, and food security, claiming two-thirds of voters support this dual approach.

However, The Alliance’s $264 million ask isn’t pocket change. Connecticut’s fiscal guardrails — spending, revenue, and volatility caps, plus a bond lock — have been transformative since 2017, saving $170 million annually in pension debt payments. The state has cut nearly $10 billion in pension debt, enacted its largest income tax cut, and freed $700 million for vital services. If maintained, the guardrails could save $7 billion over 25 years.

Despite the General Assembly’s unanimous 2023 approval to extend them, Gov. Lamont wants to “rethink the volatility threshold,” while Comptroller Sean Scanlon has called for adaptability to address pressing needs. Yet, Connecticut lags in key economic indicators: it’s among the worst states for business, with high property taxes, a poor tax climate, and steep electricity rates.

Increased spending isn’t charity — it fuels inflation, raises living costs, and “crowds out” private investment, per Forbes. The fiscal guardrails offer a path to prosperity, and tweaking them risks undoing gains, harming creditworthiness, and raising future borrowing costs. With President Trump’s tariffs adding market uncertainty, caution is key — especially with the volatility cap, which saves unpredictable revenue (e.g., stock gains) to shield taxpayers from shortfalls.

Connecticut lawmakers must reject the notion that it’s the government’s role to bankroll ideologically charged nonprofits, especially at the expense of fiscal stability. The state’s duty is to serve all residents — through essential infrastructure, public safety, and economic opportunity — not to pick winners and losers among divisive causes like abortion, illegal immigration, or gender ideology.

Busting the fiscal guardrails to funnel taxpayer dollars into such polarizing missions isn’t just reckless; it’s a betrayal of the public trust. Government should not play philanthropist with money it doesn’t own, forcing citizens to fund agendas they may abhor. True charity comes from the heart, not the statehouse. By clinging to fiscal discipline and rejecting this overreach, Connecticut can safeguard its financial future and leave divisive missions to the realm of voluntary giving — where they belong.

Andrew Fowler is the communications specialist for Yankee Institute. Frank Ricci is a Labor Fellow at the Yankee Institute, past president of the New Haven local of the International Association of Fire Fighters union, and a retired battalion chief.

Another excellent article to educate the masses.

This clown car Geenral Assembly needs to get it's priorities in shape. Republican leaders in the House and Senate have put forth proposals for reigning in the high cost of electricity in the state.No interest from Democrats. Democrats focus on spending money to their donor supported causes. With a new sheriff in town any state propagating gender theory and DEI policies is going to find the DOJ and Department of Education going after them.