CT’s Persistent Affordability Crisis

Recent national mediocre rankings reflect high cost of living, and a need to adhere to the fiscal guardrails

*This article was originally published by the CT Mirror.

In several recent national surveys, Connecticut received mediocre-to-poor rankings for its business climate, economy, cost-of-living, and property taxes. However, these low performances are not anomalies — but the status quo, highlighting the state’s prolonged struggle to reverse its affordability issues.

In early July, CNBC released its annual “America’s Top States for Business” report in which the Constitution State finished middle-of-the-pack, placing 28th overall. The top five were North Carolina, Texas, Florida, Virginia, and Ohio.

Despite Connecticut improving its overall ranking by four positions from last year, driven mostly by leaps in subcategories like ‘workforce,’ the state still lags in critical areas such as ‘Economy,’ ‘Cost of Doing Business,’ and ‘Cost of Living.’

Connecticut’s subcategory scores from CNBC are consistent with other national and local surveys released over the past year, indicating a concerning pattern.

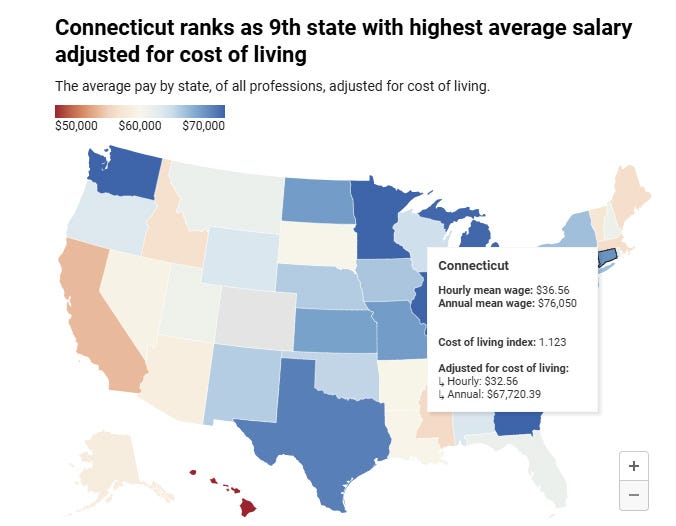

WalletHub ranked Connecticut 49th for starting a business; and the Tax Foundation placed the state 47th for the most burdensome tax climate for the tenth consecutive year. The CT Mirror also recently asserted that while Connecticut boasts high average salaries, its cost of living is among the nation’s highest.

Meanwhile, earlier this year, Realtor.com listed Connecticut third among the states with the highest median property taxes. As the real estate website noted, “Overall, Connecticut residents faced some of the largest property tax increases in the last decade. …Bridgeport, Stamford, and Norwalk are paying some of the highest.”

When compared to other New England states, New Hampshire eclipsed the Constitution State with the second highest median property tax. Vermont had the lowest rate in the region ranking 33rd.

High electric and gas rates, coupled with Connecticut’s ranking among the worst states to retire, exacerbate its affordability crisis — which may endure without curbing government spending and regulations.

Yet fiscal restraint appears unlikely. Lawmakers are aiming to loosen the state’s fiscal guardrails — bipartisan reforms passed in 2017 to limit the growth in government spending and stabilize the state’s finances — in a rumored special session this fall. Indeed, lawmakers already broke several of the guardrails this past legislative session, despite the reforms’ effectiveness. Since enacted, they have reversed decades of pension underfunding, improved Connecticut’s creditworthiness, and saved the state more than $170 million annually in reduced pension debt payments.

And despite declaring to be a “strong believer in the spending cap,” Gov. Ned Lamont and lawmakers exceeded the constitutional limit for the first time in nearly two decades to address anticipated Medicaid shortfalls from the federal government.

Increased government spending, often funded by higher taxes, undermines economic vitality. Indeed, over the years, Connecticut has lost numerous corporate headquarters fleeing to other states (e.g., General Electric, Aetna, Alexion Pharmaceuticals, even LEGO) mostly driven by cost of business expenses.

Connecticut’s business community has expressed a lack of overwhelming confidence in the state’s economic outlook. In a 2024 survey conducted by the Connecticut Business & Industry Association (CBIA), 86% of business leaders felt the cost of doing business in Connecticut was increasing; and only 8% believed the business climate was improving, versus 39% who said it was declining.

Although Connecticut’s GDP grew by 2.6% last year, the state economy is not particularly on sound footing, contracting for the “first time in more than three years in the first quarter of 2025 amid tariff concerns, slower consumer spending, and ongoing volatility in the state’s jobs market,” according to CBIA.

These circumstances would not be as harsh if Connecticut residents received quality government services in return for higher property taxes, helping fund local government operations and schools — yet this isn’t the case. A March 2025 WalletHub report ranks the Constitution State 37th in the country for taxpayer return on investment.

In short, residents are paying more for less services.

Further tax increases to fund programs will likely worsen affordability. Higher taxes raise property costs, exacerbating cost-of-living burdens and driving residents and businesses to more affordable states. This vicious cycle leads to the foreshadowed conclusion: a reduction in the tax base.

Ultimately, Connecticut’s rankings are unlikely to improve without fiscal discipline. All roads to recovery and affordability stem from government restraint, which had once saved the state from a budgetary crisis.

Lawmakers must resist short-term spending increases, prioritizing fiscal responsibility to ensure a more prosperous future.